Hybrid Benefits

Hybrid benefits allow a best of both worlds approach. You can pass risk off to the insurance company and have higher levels of protection combined with the flexibility and cost controls of a spending account.

Power up your Wallet plan with group insurance

Give your employees the coverage they need with a flexible, comprehensive group insurance plan. Offer essential benefits like life insurance, long-term disability, critical illness coverage, and more to protect their health, their future, and their families.

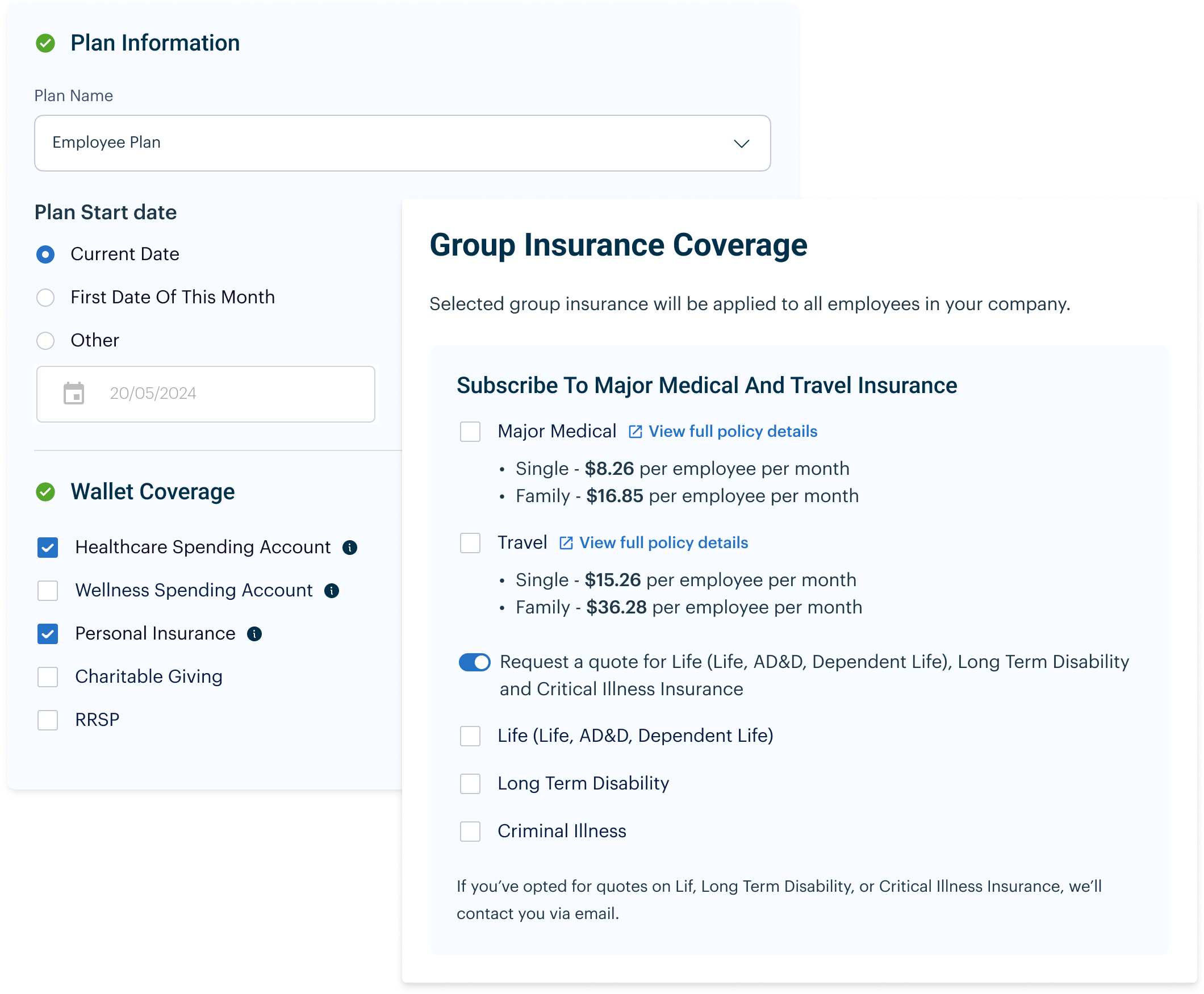

Group Insurance Add-ons

Pick and choose your desired group insurance products to add to your Wallet plan.

Life and AD&D

Life and Accidental Death & Dismemberment (AD&D) coverage ensures that your employees and their families are supported financially in the face of life’s most challenging moments.

Long-Term Disability

In the event one of your employees are unable to work due to a serious illness or injury, Long-Term Disability coverage ensures they continue to receive a stable income, safeguarding their livelihood.

Critical Illness

Critical Illness coverage provides a lump sum payment to employees facing serious health conditions, helping them manage expenses and focus on recovery without the added stress of financial strain.

Out-of-Country

Provide your employees with essential coverage for medical emergencies during international travel, giving both you and your team peace of mind.

Dependent Life

Dependent life coverage provides essential financial security for your employees' families, offering peace of mind by ensuring that loved ones are taken care of in the event of an unexpected loss.

Prescription Drugs

Ensure your team has affordable access to the medications they need to maintain their health and well-being.

Getting started is simple

Discovery

Explore the various possibilities your benefits can do

Plan Design

Set up a benefits account that is best suited for your needs

Setup and Launch

Distribute your benefits throughout the various accounts you setup

Enjoy your benefits

Once your account is ready you can submit claims to use your benefits

Frequently Asked Questions

What is Vintners' Select Benefits?

Vintners' Select Benefits delivers personalized benefit solutions that safeguard your team and support the growth of your business. By combining innovative benefits technology with specialized experience, we make managing your businesses benefit plan easier, improving the overall experience for your employees. No matter the size of your operation, Vintners' Select Benefits provides a tailored solution that fits your needs.

Who is Vintners' Select Benefits insurance for?

Vintners' Select serves owners and their employees. Vintners' Select Benefits insurance is designed for operations of all sizes, offering tailored benefit solutions to protect their teams and support business growth. Whether the business is large or small, Vintners' Select Benefits provides customized insurance plans to meet their specific needs.

How do you prepare my quote?

Once you request a quote, we call you for a personal consultation. In this conversation, we go over your needs and help you understand your current coverage and options to simplify things, reduce costs or meet your objectives. To produce an illustration or “quote” we require a census of your employees and if you have an existing benefit plan, some information on your plan experience and most recent rate renewal. We then show you how to get the solution you need to put your mind at ease. With our quote and consultation process, you will leave the discussion with an understanding of where your current coverage may or may not meet your needs and how you can save money with Vintners' Select.

Can you be more specific about what Vintners' Select Benefits offers?

Vintners' Select offers employee group insurance benefits like extended health and dental and employee spending accounts. Vintners' Select also offers personal insurance like life insurance, disability insurance and critical illness insurance. For owners, we provide life insurance to fund shareholder/partnership agreements and valuable advice on how to run business and personal affairs better through integrated planning. Integrated planning lets owners integrate their business and personal planning to avoid gaps and eliminate overlaps for greater cost and tax efficiency.

I’m busy so what’s the best way for me to learn about Vintners' Select Benefits insurance products and services?

We designed our website with busy owners in mind! We know that you want to research your options at your convenience, so we put as much information as possible right here on our website. By the time you finish reading our site, you will know who we serve, what our products look like and the answers to your most frequently asked questions. However, we feel a personal touch and “learning your way” is the best approach. We are happy to provide customized information, whenever possible visit your business, or simply join a call to talk about your needs and your goals.